Menu

Menu

Menu

Menu

Once you register as an owner with Horse Racing Ireland (HRI), you will gain access to a personal HRI customer account to manage your daily racing activities, including race entries and prize money distribution. The system used for this is called RÁS.

The RÁS online system functions much like a personal online banking system. Owners can view all transactions processed through their account, search historical records, and print statements. You can manage and track all your transactions by visiting https://admin.hri-ras.ie.

For further information on the RÁS system, please contact Client Accounts at +353 (0)45 455444.

There are a variety of racehorse ownership options available to suit all budgets, so you can choose the type of ownership that works best for you. To help you better understand the costs involved, we’ve outlined some of the typical fees and expenses you can expect as an owner, allowing you to budget accordingly.

Training fees can vary depending on the trainer, with daily rates ranging from €45 to €70 per horse. On average, the cost of training in Ireland is about €1,900 per month, which typically includes basic additional expenses.

It’s advisable to request a detailed breakdown of costs from your trainer. This should include not only the daily training fees but also any extra costs such as gallop fees, farrier charges, veterinary care, transport, and race day expenses.

Owners have the option to pay their trainer directly or through their HRI account. To make a payment via the HRI account, owners should send an invoice (with their name included) to the Client Accounts team at [email protected], who will process the request.

.png)

One of the first decisions a new owner faces is where to source their horse. Many owners turn to their trainer for advice and guidance.

There are several options to explore when acquiring a racehorse:

These options cater to a variety of budgets. For more details on each choice, visit our Source Your Horse section.

.png)

At the time of registration with Horse Racing Ireland (HRI), a minimum lodgment of €500 (€1,000 for clubs & companies) is required to keep a working balance in the account.

This initial lodgment covers your registration fees and leaves funds in your account to cover the cost of your first run.

Once registered as an owner with Horse Racing Ireland (HRI) you will have access to a personal HRI customer account to manage your daily racing activity such as entries and prize money distribution. The HRI customer account system is called RÁS.

Owners have access to the RÁS online system that acts much in the same way as a personal online banking system does. Owners can view all transactions processed through their account, search historical records or print off statements etc. Owners can manage and view all transactions on https://admin.hri-ras.ie

To view the HRI 2025 Registration fees CLICK HERE

For more information on the RAS system contact Client Accounts on +353 (0)45 455444.

.png)

After registering as an owner with Horse Racing Ireland (HRI), you will gain access to a personal HRI customer account to manage your daily racing activities, including entries and prize money distribution. This system is called RÁS.

Through RÁS, owners can view all transactions processed in their account, search historical records, and print statements, among other features.

For more information about the RÁS system, please contact Client Accounts at +353 (0)45 455444.

.png)

Race entry costs can vary depending on the value of the race, but on average, it costs around €350 to enter. If a horse is balloted out of a race, the entry and declaration fees will be refunded, and no jockey fee will be charged.

Race Entry Breakdown:

| Entry Fee | 0.8% of total race value |

| Declaration Fee | 0.2% of total race value |

| Bookage (Admin) Fee | €12.50 per race |

| #Jockey Fee Per Race | €189.76 Flat Ride / €216.86 National Hunt Ride |

Note: Higher charges apply for Pattern, Group, and Listed races.

Jockey fees are subject to a 13.5% VAT if the jockey is VAT registered.

.png)

Prize money is deposited directly into the owner's Horse Racing Ireland (HRI) account. To allow for routine testing, these funds are not available for withdrawal until seventeen days after the winning race day.

To withdraw prize money, each owner must have registered their personal banking details with HRI. This requires submitting a copy of their bank statement header, clearly showing their name, IBAN, and account number.

The minimum prize fund for any race in Ireland is €10,000, with the prize fund increasing based on the type of race. Prize money is awarded to connections up to 6th place. On average, 70% of owners in Ireland receive prize money.

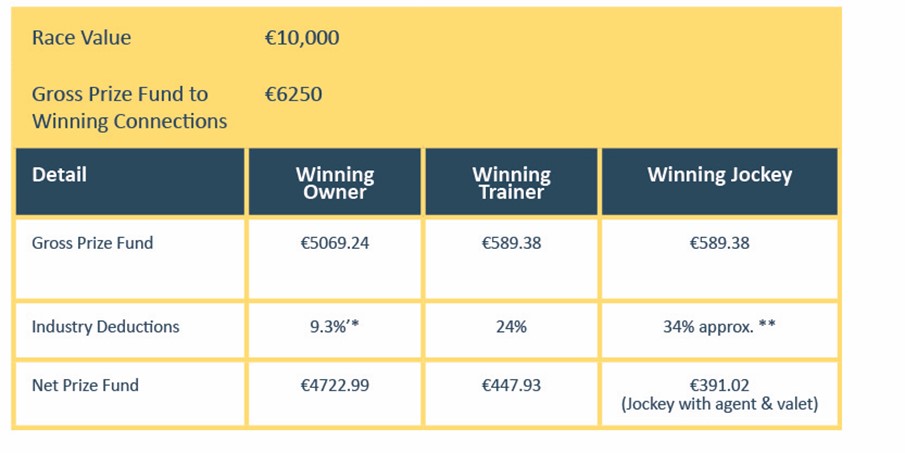

A detailed breakdown of prize money allocation and any deductions can be found on the RAS website. Below is an example of how prize money is allocated:

Note: Owner industry deductions include race entry fees and contributions to the IHRB, Stable Staff, and Jockey Emergency Fund. A full breakdown of deductions is available on the owner's RAS account.

Jockey deductions vary based on agent fees, valet fees, VAT, etc.